GT Gold Corp's saddle deposit was causing a lot of excitement last year and have recently announced some decent new results (

link and

link).

Summary

- Drilling has defined a small, moderate grade deposit.

- Moderate expansion potential:

- South Zone: partially open to the East and West

- North Zone - TTD057 hit good values, but surface Au samples suggest that this zone is small.

- Porphyry mineralization in hole TTD062 is interesting, but not economic. Highest grade zone appear to be restricted to narrow zones (dykes?).

- Decent Au recoveries from initial metallurgical studies.

I was pleasantly surprised that GT gold include a full breakdown of the DH assays (

link) on their website, and as this is a new project for me I want to look at 3 areas:

- Size

- Upside

- Potential problems

For your viewing pleasure, you can download the Leapfrog viewer file from here (

link). Please note, I haven't found the RC collar information, so they are

not included.

Size

I did my normal thing, brought in the assays, had a look at the data to see if there were any trends confirm GT Gold's interpretations, that gold occurs in a series of steeply dipping veins.

|

| Green arrow = mineralization plunge |

I used this trend to create a series of grade shells.

To calculate a guesstimate of contained gold.

It looks like GT Gold have defined a small, but moderate grade resource. How can they make it bigger?

Upside

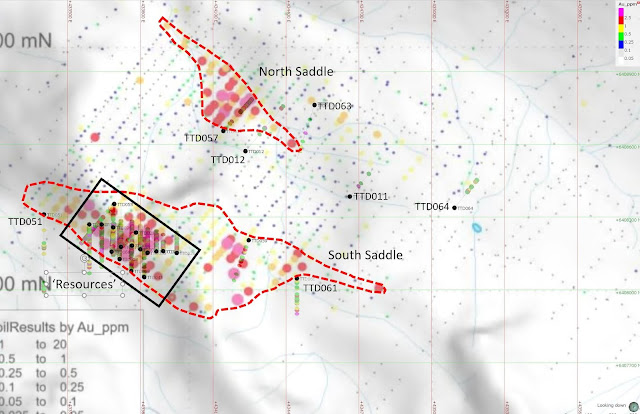

I want to see how easily GT Gold can expand the gold mineralization. So I decided to compare the drilled gold zones against the prospect-wide soil sampling maps found in the 2016 technical report.

Gold

|

| Au DH assays and Au in soil |

Arsenic

|

| Au DH assays and As in soil |

We can see that surface gold and arsenic correlate well with the gold mineralization hit by the drilling. You can also see that the 2 large soil anomalies haven't been completely drilled.

South Saddle

|

| proposed hole = cyan lines |

The South Saddle Zone has been well drilled, but we can see that the Au soil anomaly continues for another 300m to the NW. We can also see that hole TTD051 missed, at GT gold should drill a hole (highlighted) from this platform to the NE to check for the continuation of the multiple Au zones hit in drill-hole TTD053

We also see a partially tested anomaly ~250m to the East. Drill hole TTD059 hit several >1g/t Au structures and a few holes between this hole and TTD028 will test the continuation of the main South Saddle deposit to the east.

GT may also want to drill a DH to the N from the platform of hole TTD061 to test another small Au soil anomaly to see if these three zones link up.

North Saddle

The North Saddle gold anomaly is virtually untested, and is 400m long and ~250m wide. The anomaly does appear to be following a drainage and may just be an erosion anomaly, but drill-hole TTD057 hit multiple >1g/t Au structures along the eastern edge of this anomaly and a couple more holes should be drilled to see if there is anything bigger to find in the area.

Porphyry

Hole TTD062 hit some weakly mineralized porphyry (210m @ 0.16% Cu and 0.14 g/t Au - i.e. waste) and the hole was drilled into the center of the large magnetic anomaly, so it it doesn't look like it will turn into anything.

|

| Magenta = magnetic high |

Regionally

The 2016 technical report does discuss additional targets, I've been happy to see that there is good correlation between soil Au and As and drilled mineralization, and maybe a good step would be to expand the soil sampling program across the project, and if GT gold want to save a few bucks (and get quicker results), they could use a pXRF on the soil samples and map out the Arsenic as a proxy for gold distribution.

Metallurgy

We got a Valentine's gift from GT (

link) with some initial metallurgical results. I quickly checked Head grade against recovery to make sure that GT tested material with different head-grades (it is common for companies to only test the 'best' material which can skew the results).

We see a nice range of head-grades from low to high, and the recoveries are sitting nicely around the 80% level. I didn't see anything in the text to explain why 2 composites had 0% recovery, it would have been nice to have had a bit of text explaining why. It would have been nice to have seen a summary of ore type (oxide, mixed and sulfide - if it is important) and maybe where the samples had come from, but these are minor niggles.

I've created a new view showing the location of the Cu assays in the DH data (

link)

Conclusion

GT gold have defined a small, moderate grade gold deposit. There is reasonable expansion potential laterally, the depth extents to the South Saddle appear to be well drilled), and my gut-feel max size for Saddle/Saddle north is sitting around ~1Moz @1 g/t.

The metallurgical studies are positive, and appear to minimize any potential impact that the elevated As could have had on the deposit.

However, I can't see, from the data presented, how GT will significantly expand the project to a size where larger companies would be looking at acquiring it (say around 2Moz). Maybe with some regional exploration, several additional gold zones could be defined for drilling later on this year.

The porphyry potential, albeit from a single hole, seems to be minimal.